Chris Szewczyk

Curated From www.pcgamer.com Check Them Out For More Content.

Though PC Gamer is first and foremost a website dedicated to PC gaming and hardware, we’ve been covering the escalating technology and chipmaking dispute between China and the US and its allies. Whether it’s the blocking of vital chip making equipment, or banning of the sale of certain AI chips, this latest act in the tit for tat tech dispute could directly affect how much we pay for our rigs.

Following the new US proposal to ban the sale of Nvidia’s most advanced AI chips to Chinese businesses, China has announced new controls on the export of various gallium and germanium materials and products. According to Bloomberg, these controls will come into effect on August 1. Companies exporting the metals must apply for licenses and provide information about who they’re selling to and what the metals will be used for.

The reason for the controls are to “safeguard national security and interests” according to a statement released by the Ministry of Commerce of the People’s Republic of China.

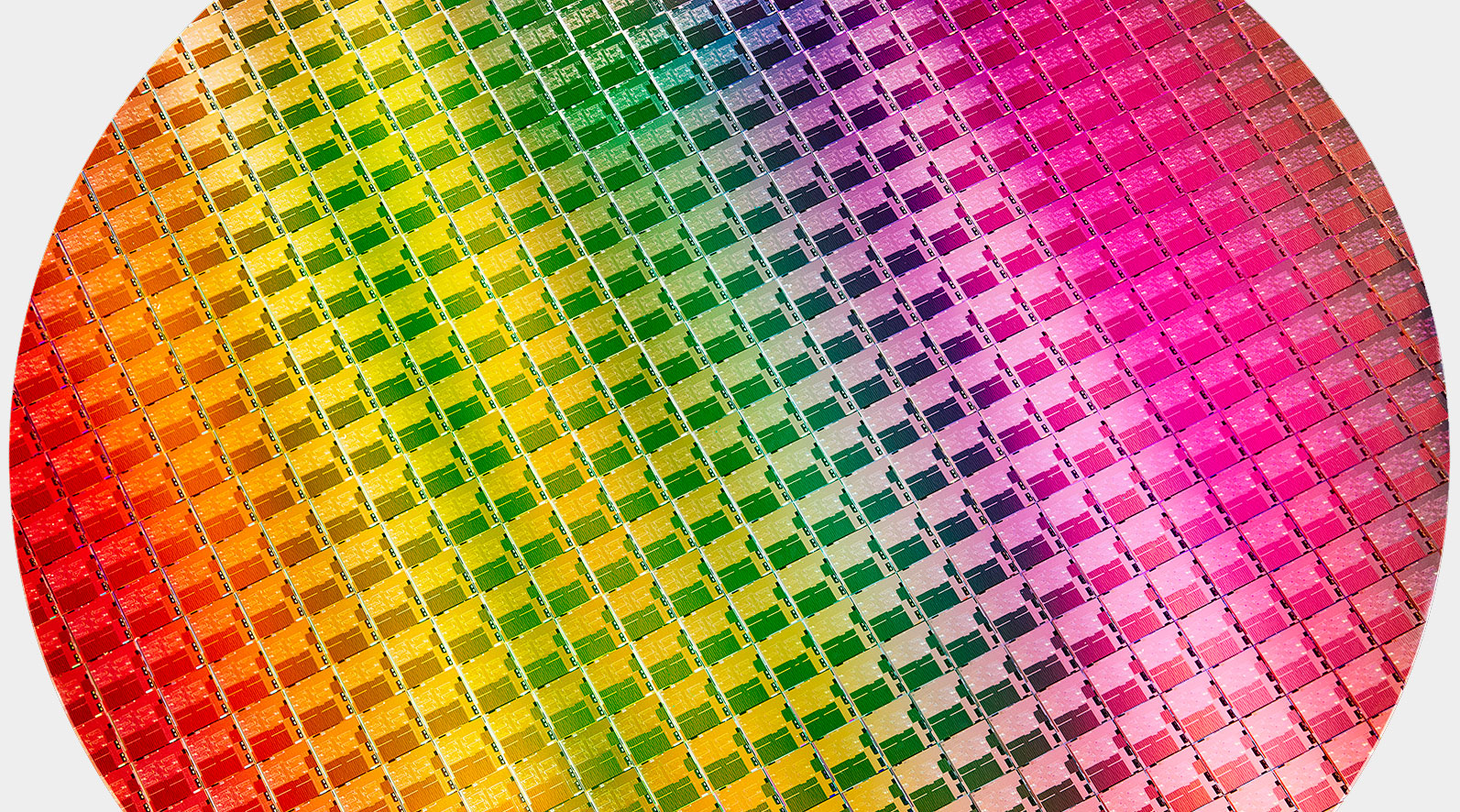

These metals are vital to the manufacturing of semiconductors. Germanium was a critical component of early transistor design before being replaced by silicon, though it’s seeing a resurgence when combined with silicon to produce silicon-germanium alloys. Among other things, it’s also used in the manufacture of high efficiency solar panels, optical fiber, high intensity automobile headlights and the backlights of LCD monitors.

According to Bloomberg, 94% of the world’s gallium production comes from China. Gallium is much more relevant to chip manufacturing, but it’s also an important component of mobile phones, wireless communications products and notably, blue LEDs.

China is by far the largest producer of both metals, though this position is more about cheaper production costs than the abundance of the metals themselves. Christopher Ecclestone, principle at Hallgarten & Co. told Bloomberg: “When they stop suppressing the price, it suddenly becomes more viable to extract these metals in the West, then China again has an own-goal.”

Though China is not blocking export of the two metals, It remains to be seen what impact this move will have on the wider tech industry. Chip manufacturing is a forward looking process and there will be stockpiles and reserves of important components in case there’s a supply side shock. But these materials are used for more than just chipmaking, and there’s every chance there will be some ripple effects and price hikes on some products in the months ahead.

One thing we can be sure of: this tech war has the potential to escalate a lot further. Advanced technologies including AI, quantum computers and sub 1nm nodes contain secrets that countries do not want to share.